Fixed vs. Variable

Fixed vs. Variable

Is a Fixed Rate or Variable Rate better for me?

That largely depends on:

- Your current financial situation

- The stage you are at in your life cycle

- Possible/probable changes that you may expect in your future (children, job stability, retirement, etc.)

- Your tolerance for risk

The difference between the fixed and the variable rate mortgage is that the variable rate can fluctuate, directly affecting how much you pay. The cost of having a predictable mortgage payment (fixed mortgage) has varied widely over recent years even though rates have remained low. When determining your best mortgage choice, in addition to the other factors listed, you should also consider what the current cost of the more predictable fixed mortgage term is.

The BOC dropped their overnight rates to historic lows in 2020, brought on by the pandemic in a bid to keep the economy stable, this was not meant to be a lasting measure. As businesses start to regain sales growth and in consideration of the current inflationary levels, the Bank wants to bring rates into a range more consistent with the current economic reality.

The variable rate that you receive on a mortgage is based on a variance of plus or minus the lender’s prime rate. Since 2009, that variance has been as low as prime minus 1.20% and as high as prime plus 0.90%. If the prime rate was 3.00%, that would be a variance from 1.80% to 3.90%, all without the rate itself changing.

Why does the variance change?

There are a number of factors including:

- Competitive pressures

- Contracting or expanding of lender risk tolerance

- Government policies

- Supply and demand of investment capital

Remember, if and when the prime rate changes, the variance to that prime rate is locked in for the term of your variable rate mortgage, so the rate will change, but the variance to prime will not.

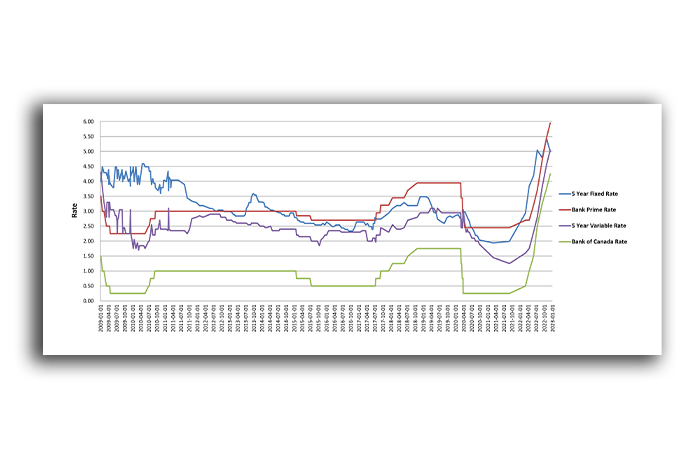

We have done an analysis of our fixed term and variable rate interest rates dating back to January of 2009. This is proprietary rate data based on interest rates offered by the 30 or more lenders that we work with regularly on behalf of our clients.

During this time period some interesting facts emerged:

- Variable rates were as high as prime +0.8% and as low as prime -1.20% during this time period.

- The Bank of Canada dropped the overnight lending rate by 0.50% in March 2020, the first decrease since 2015.

- The Bank of Canada added a total of 4.75% in increases from March 2022 to July 2023 to fight inflationary pressures.

- In June 2024 we saw the first rate decrease since the pandemic. This indicated that the economy was stabilizing and a strict monetary policy was no longer mandatory.

Fixed versus variable is a decision that you should discuss with a Mortgage Professional based on your personal circumstances. One of the factors you should include in your consideration should also be the “cost” of the “insurance premium” for a fixed term mortgage, and the value that is provided for that “premium” which you can see, changes over time and with market conditions.